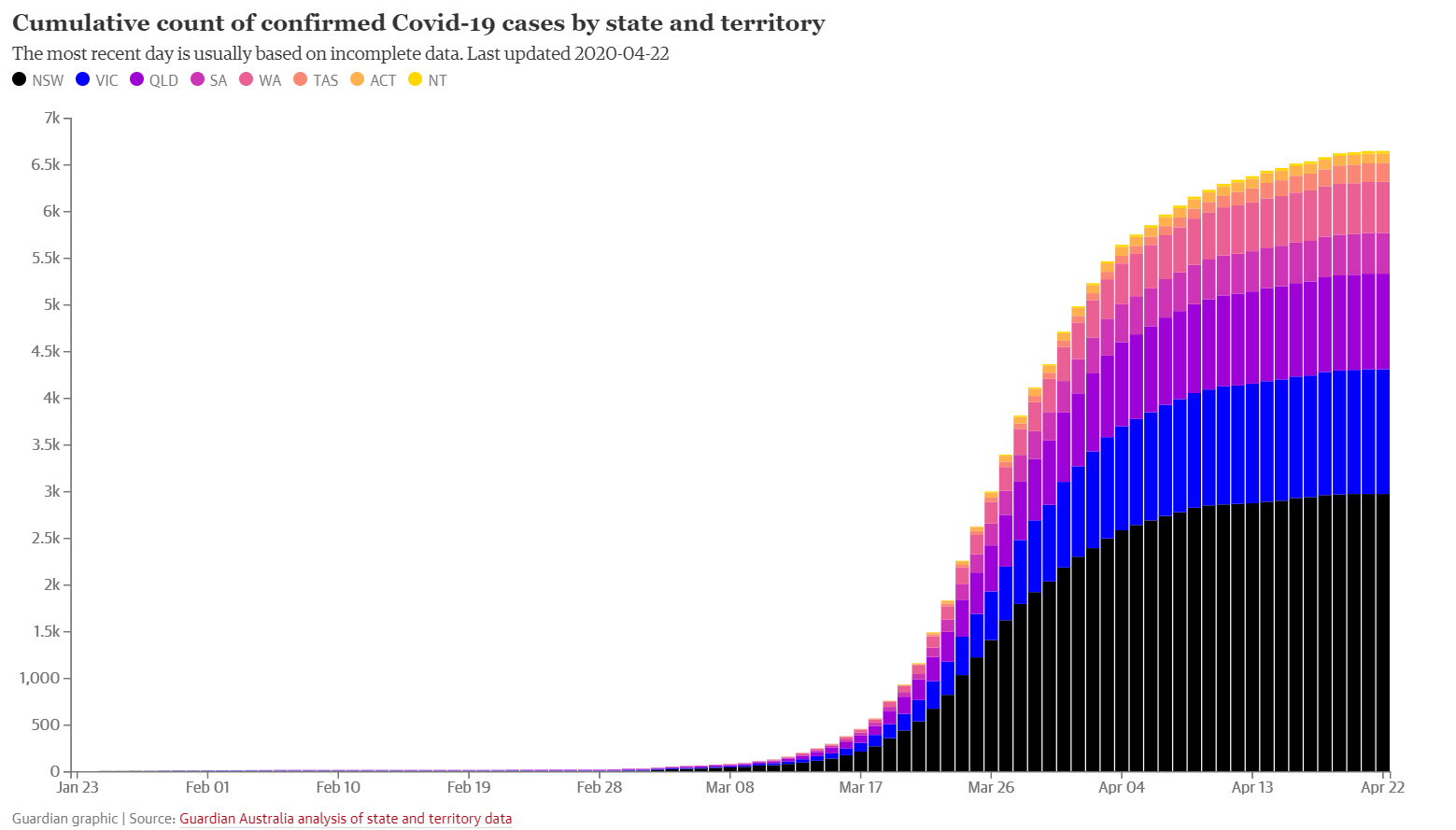

Firstly, it's been great to see the huge reductions in new daily cases across Australia and possibly some light at the end of the tunnel.

You can see in the graph below just how quickly our curve of total infections has flattened, I don't think a result better than this could have been expected just a few weeks ago.

Graph via The Guardian

This is another positive. We might be able to enjoy some freedoms again, however, will need to remain cautious coming into winter. A second wave, as seen recently in Singapore, will do us no favours.

Markets, as always, remain unpredictable. Who knew a contract on oil might go into negative territory? Without anywhere to store oil it becomes more about the price to hold it than the actual price of the commodity.

Back to shares, and for almost the last month there has been a substantial rally. Up 20% plus on the Australian market and up 30% plus in the US. Even with these upward movements there have been some large falls, especially on the ASX. Falls of 5%, 3.5% 1.6% 1.3% and 1.2%, all within a confine of a 20% rally that occurred in less than a month. That is volatility.

Markets will be more sensitive to various pieces of economic and financial data. We should expect them to swing wildly for the foreseeable future. We’d like to hope they would at least hold their ground, but they could as equally revisit previous lows. Nothing should be discounted as a possibility. Even going upwards again.

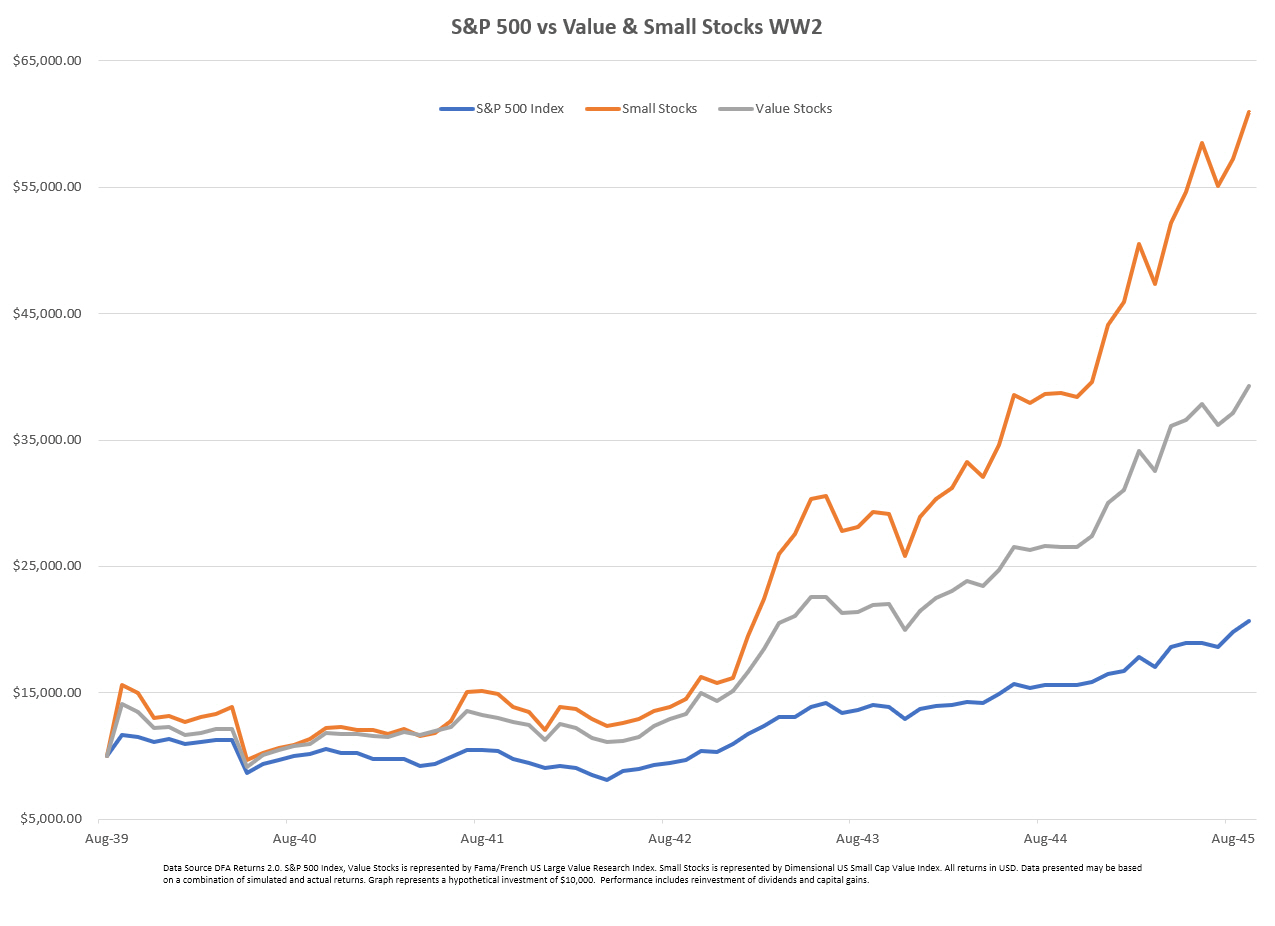

Possibly the best way to consider the impact of COVID-19, in respect to the various curtailments and their impacts, would be akin to countries when at war. Travel is effectively off limits; various parts of the economy are shuttered, and freedoms are curtailed. In respect to a war they are generally multi-year events. Gauging the prospect of a war’s end? Hard to do. We would hope COVID-19 won’t be a multi-year affair.

In considering market movements One particularly interesting chart is the behaviour of various market factors around WW2. Across the six-year period of WW2, the S&P 500 doubled in the US, but at one point it fell 38%. What’s interesting is the behaviour of small and value stock indexes during that period. Small stocks were up over 500% during WW2 and value stocks were up nearly 300%. At one-point small stocks fell 52% and value stocks fell 48%.

The idea is being around to capture the gains when they appear. If an investor has stuck around for the risk, they may as well enjoy the reward. It is also important to keep in mind there will be various factors in the market that may outperform when a recovery eventuates.

Finally, we’re pleased to note, we have had no reports of any COVID19 cases from us, our friends or family or businesses in our little area. Also, across our clients, we’re happy we haven’t had any reports of COVID-19 exposure. We hope this continues and you all remain in good health.

Until next time.

Reproduced with permission from Mancel Finanical Group. This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.

No comments:

Post a Comment